JupiterMoon said:

I don't think so. Applying the full $7500 to the cap cost

To be clear, we are talking about adding $5,000 of Capital Cost Reduction (to make the CCR $7,500 total) and simultaneously lowering the residual by $5,000.

JupiterMoon said:

would lower your base payment

No, the base payment is the amortized depreciation, based on capital cost - residual, which is unchanged by the above.

JupiterMoon said:

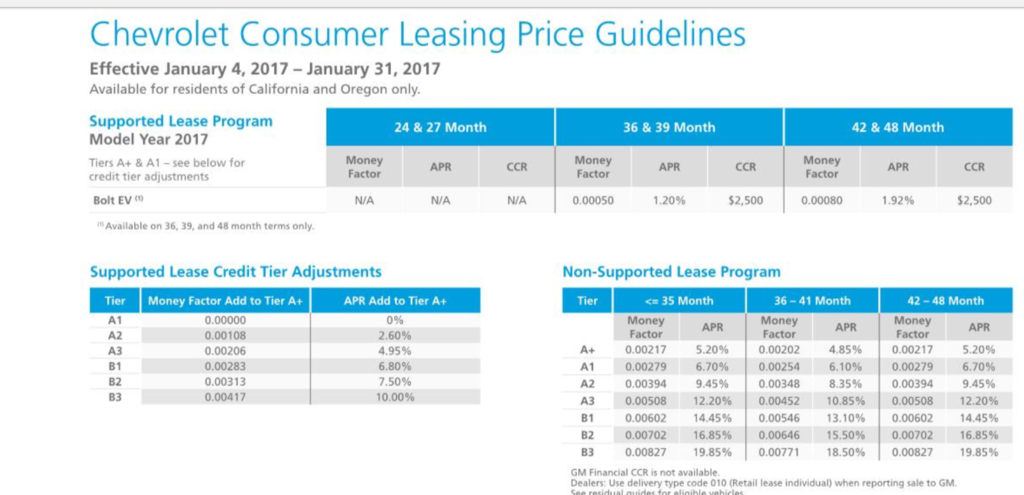

Yes, your rent on a 3 year lease would be lower by (roughly?) 3 * APR * $5,000. If you get a 0.0005 Money Factor, the APR is 1.2%, so that's 3.6% of $5,000.

JupiterMoon said:

and the tax on the sum of those two.

Yes, you'd save the sales tax on the reduced rent, so 9% of 3.6% if the sales tax rate is 9%. So your total savings would be 3.924% of $5,000. But you'd own sales tax on that extra $5,000 of Capital Cost Reduction, or 9% of $5,000.

Thus in California, if you intend to turn in the car at lease end anyway, inflating the residual by $5,000 saves you a bit over 5% of $5,000 over the course of the lease, or $250.

Cheers, Wayne