Without getting into what impact a GM "loss" on the Bolt might mean (good, bad or indifferent), I thought I'd do a rough EV vs ICE comparison to see what it would take for GM to have a $9000 loss on the Bolt (parts & labor).

Since we are not privy to the actual costs, we can take a different approach - look at the cost differential between a similar ICE vehicle and the Bolt. I decided to use the Cruze Hatchback as a comparison vehicle.

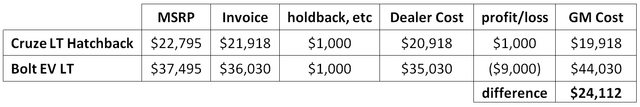

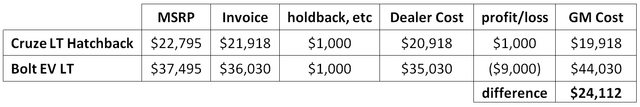

First, let's take a look at our best guess for the cost of the Cruze and the Bolt. Invoice price is readily accessible. The true sell cost to the dealer is another matter, but we can make a pretty good guess. The amount in the memo line is pretty close to what the dealer will actually wind up paying for the car.

http://www.mychevybolt.com/forum/viewtopic.php?f=3&t=4945#p9713

It's about $1K less than invoice.

If we assume that GM is not making much on the Cruze (just $1K) and they are losing $9K on the Bolt, here is what we wind up with:

So for the $9K number to be true, the Bolt will cost ~$24K more to manufacture than the Cruze (more than double). Sounds high, but let's take a closer look.

The body, interior, suspension, etc are similar enough to be a wash. The drive train and battery (on the Bolt) are where the cost differential would originate.

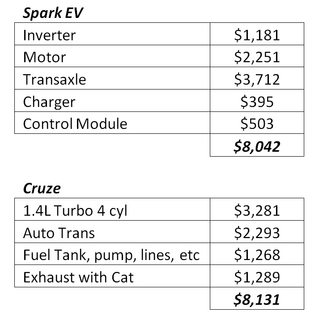

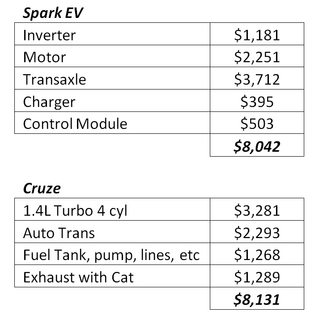

We don't have access to part costs on the Bolt, but we do on the Spark EV and the Cruze.

I chose the Spark EV because retail parts prices are available on the electric motor and associated components. They won't match exactly, but should be in the ballpark. The Cruze Hatchback with auto trans is a decent ICE comparison for the Bolt (and the motor/trans/etc are common to many GM vehicles in that size and price range).

Retail Parts prices (from GM OEM parts sites):

Both will have cooling systems, gauge clusters, brakes, etc. Plus some miscellaneous parts unique to their fuel type (charging port, fuel filler neck & cap, etc.). I didn't add up every bolt and bracket, but took the major components (the whole assemble when available). I consider this portion to be a wash.

That leaves the battery pack.

We have a $145/kWh cell figure on the Bolt, so if they use 70 kWh (to get 60 usable), cell cost is ~$10K. If we allow a generous $7K cost for the tray, heater, cooling, brackets, etc that would put the cost to GM of the Bolt EV pack assembly @$17K (it's very likely less than that). Retail on the Spark EV pack is $11,889 and it has similar requirements for cooling/connectors/tray/etc.

So, in conclusion, for the ~$9K loss to be accurate, the battery pack would need to cost GM at least $24K (or $14K in assembly costs after the $10K in battery costs). In fairness, there might be some additional costs for an EV (relays, heavy duty wiring, etc) that might add a little over the cost of an ICE ($1K?, $2K?), but nowhere near what it would take to make up the difference.

Are these exact numbers? Not in the least. But close enough to make me question the validity of the $9K loss claim by "a person familiar with the matter".

Once again, this is not an argument on whether or not it is good or bad if GM is "losing money" on the Bolt, or the impact of ZEV credits, meeting CAFE requirements, etc., but an attempt to test the validity of the claim.

Since we are not privy to the actual costs, we can take a different approach - look at the cost differential between a similar ICE vehicle and the Bolt. I decided to use the Cruze Hatchback as a comparison vehicle.

First, let's take a look at our best guess for the cost of the Cruze and the Bolt. Invoice price is readily accessible. The true sell cost to the dealer is another matter, but we can make a pretty good guess. The amount in the memo line is pretty close to what the dealer will actually wind up paying for the car.

http://www.mychevybolt.com/forum/viewtopic.php?f=3&t=4945#p9713

It's about $1K less than invoice.

If we assume that GM is not making much on the Cruze (just $1K) and they are losing $9K on the Bolt, here is what we wind up with:

So for the $9K number to be true, the Bolt will cost ~$24K more to manufacture than the Cruze (more than double). Sounds high, but let's take a closer look.

The body, interior, suspension, etc are similar enough to be a wash. The drive train and battery (on the Bolt) are where the cost differential would originate.

We don't have access to part costs on the Bolt, but we do on the Spark EV and the Cruze.

I chose the Spark EV because retail parts prices are available on the electric motor and associated components. They won't match exactly, but should be in the ballpark. The Cruze Hatchback with auto trans is a decent ICE comparison for the Bolt (and the motor/trans/etc are common to many GM vehicles in that size and price range).

Retail Parts prices (from GM OEM parts sites):

Both will have cooling systems, gauge clusters, brakes, etc. Plus some miscellaneous parts unique to their fuel type (charging port, fuel filler neck & cap, etc.). I didn't add up every bolt and bracket, but took the major components (the whole assemble when available). I consider this portion to be a wash.

That leaves the battery pack.

We have a $145/kWh cell figure on the Bolt, so if they use 70 kWh (to get 60 usable), cell cost is ~$10K. If we allow a generous $7K cost for the tray, heater, cooling, brackets, etc that would put the cost to GM of the Bolt EV pack assembly @$17K (it's very likely less than that). Retail on the Spark EV pack is $11,889 and it has similar requirements for cooling/connectors/tray/etc.

So, in conclusion, for the ~$9K loss to be accurate, the battery pack would need to cost GM at least $24K (or $14K in assembly costs after the $10K in battery costs). In fairness, there might be some additional costs for an EV (relays, heavy duty wiring, etc) that might add a little over the cost of an ICE ($1K?, $2K?), but nowhere near what it would take to make up the difference.

Are these exact numbers? Not in the least. But close enough to make me question the validity of the $9K loss claim by "a person familiar with the matter".

Once again, this is not an argument on whether or not it is good or bad if GM is "losing money" on the Bolt, or the impact of ZEV credits, meeting CAFE requirements, etc., but an attempt to test the validity of the claim.